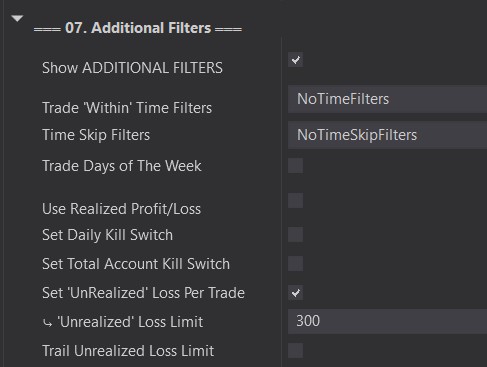

Unrealized PNL Per Trade

The Unrealized Loss Per Trade is used to help limit the losses on each trade. This is like a kill switch. The main difference is that instead of being a daily limit, the unrealized is only limited to each individual trade.

There may be scenarios where your stop is being set based on the candle size. This can sometimes lead to entering with a position that can expose you to a much bigger risk. Or maybe you are adding to a position and just want a quick way to limit your potential losses.

Note that it will only exit trades on the chart that the Predator was enabled on, with this option selected. It will only exit trades entered by the Predator!

Unrealized Loss Per Trade Example:

Static Unrealized Example

Initial Entry:

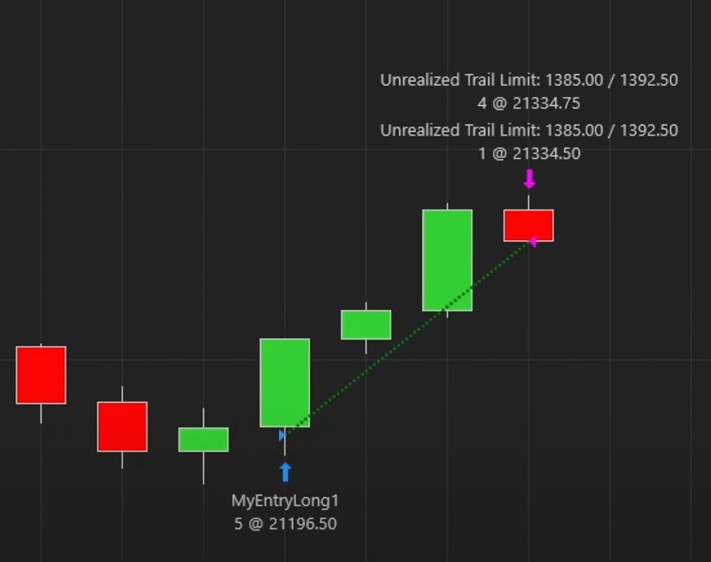

In this first screenshot, we can see the stop order is set at the bottom of the candle.

You will see text appear on the chart to make it easier to see your current Unrealized PNL and at what point it will exit the trade.

Exit Trade:

In this second screenshot, we can see the Unrealized limit took us out of the trade before our stop because we reached our limit of $300 per trade.

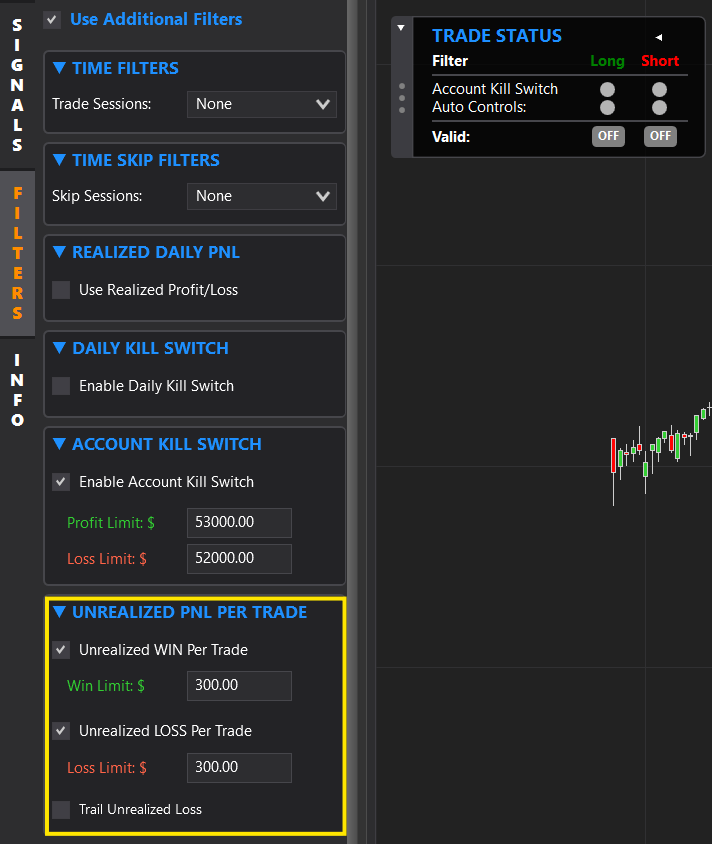

Trail Unrealized:

Unrealized Trail means that as your position keeps going into profit. Your Unrealized limit will keep trailing from the highest Unrealized amount.

In this example, using a $300 unrealized limit, we managed to capture a bigger profit and only exit our position when we lose $300 from the highest point.